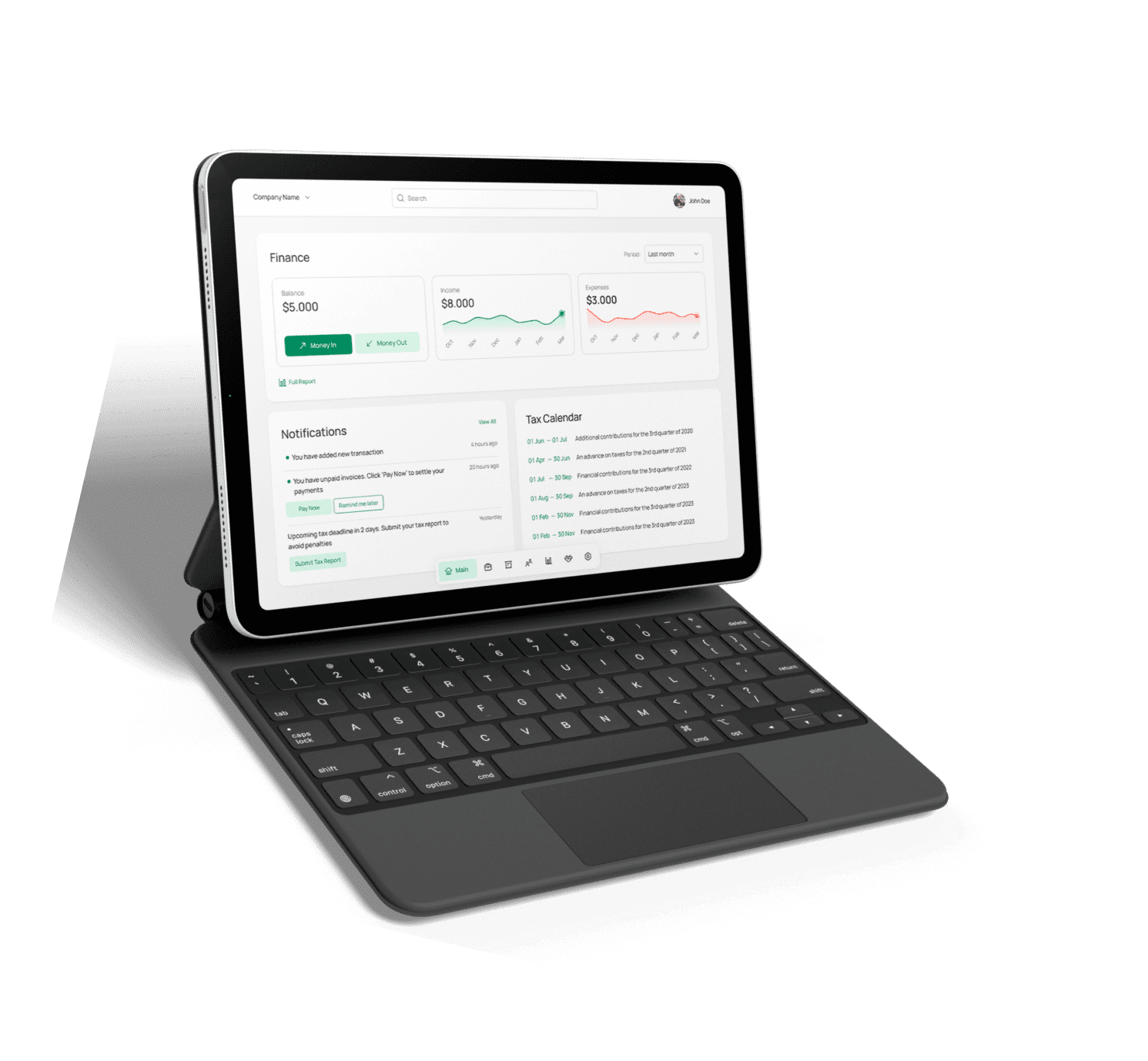

HOW THE SERVICE WILL HELP YOU KEEP RECORDS ON YOUR OWN

Sahl.tax automates processes, saving you money, time, ensuring accuracy and full compliance with the laws

Comprehensive tools for accounting,

taxation, and financial management

Elimination of errors and

acceleration of processes

E-document management with

connected companies

Expert recommendations

for managing financial

and tax burdens

Significant cost savings on

accounting services

User-friendly interface

accessible to everyone

Automatic migration of transaction

history and invoices from your

current system to Sahl.Tax

Comprehensive tools for accounting,

taxation, and financial management

Significant cost savings

on accounting services

Elimination of errors and acceleration of

processes

Expert recommendations for managing

financial and tax burdens

Automatic migration of transaction history and invoices from your current system to Sahl.Tax

User-friendly interface accessible

to everyone

E-document management with connected

companies

Current bookkeeping

problems in the UAE

Strict reporting

on income tax and VAT

from 2025

Increased expense

for traditional

accounting services

Higher risk of error

due to manual data entry

and the human factor

Slow and inefficient

data processing

Reliance on third-party services

for invoice generation

complicates the process

Need to consider specific nuances

such as VAT exemptions for companies

with income below 375,000 Dhs.

Strict reporting

on income tax and VAT

from 2025

Increased expense

for traditional

accounting services

Higher risk of error

due to manual data entry

and the human factor

Slow and inefficient

data processing

Reliance on third-party services

for invoice generation

complicates the process

Need to consider specific nuances

such as VAT exemptions for companies

with income below 375,000 Dhs.

AUTOMATE YOUR UAE ACCOUNTING WITH SAHL TAX

Integrations

and API

- Integratios with popular systems such as Salesforce, SAP, and Microsoft Dynamics AX

- Integrations with the popular CRMs and databases (DWH)

- Integration service with API access for your developers

- API access for external integrations

Managing

Multiple Companies

- Ability to manage multiple companies within a single account

- Managing the accounting of several companies in one interface

Bank Integrations and Statement Management

- Compatibility with UAE banks for automatic upload and processing of statements (PDF and Excel)

- Automatic import of transactions from the bank, without manual input

- Clarification of statement details directly within the system interface

Support for multi-currency

transactions

- For invoice generation complicates the process

- Optimization of financial transactions, including revenue accounting

- Ready finance reports (P&L)

- Data export in the convenient Excel format

All the necessary tools in one place!

AI powered Accounting Assistant

- Automatically creates missing invoices and bills from bank transactions

- Finds the exact document you need with natural language search

- Answers your questions about VAT, Corporate Tax, and Free Zone rules 24/7

Missing Document Generator

- Upload a bank payment - AI instantly generates the missing vendor bill

- Take a photo of a receipt in WhatsApp — AI creates a proper expense entry

- One click turns any transaction into a fully compliant invoice or bill

- All generated documents are 100 % FTA-ready and audit-proof

Tax Report Explainer

- You will get an instant explanation of any number in your Corporate Tax or VAT report

- See exactly how Qualifying Income, non-Qualifying Income, and losses are calculated

- Clear breakdown of deductible vs non-deductible expenses

- Step-by-step guide showing what to upload to EmaraTax

Automatic Error Detection

- Catches mistakes before the FTA does

- Flags suspicious or duplicate transactions

- Highlights missing VAT numbers or incorrect tax codes

- Warns about expenses that could trigger an audit

- Prevents common Free Zone compliance mistakes

Smart Reconciliation Assistant

- Links payments to invoices in seconds

- Drag-and-drop or let AI match everything automatically

- Handles partial payments, currency conversions, and bank fees

- Handles partial payments, currency conversions, and bank fees

One-Click EmaraTax Export

- Generates perfectly formatted files for EmaraTax portal

- Pre-fills Corporate Tax and VAT report

- Includes all required schedules and supporting documents

- Eliminates manual data entry and formatting errors

Free PDF Tools

- Add your signature to any PDF document

- Create, split, and compress PDF files

- Convert from images or text to PDF, and run OCR on scanned documents

- 100% private — your files stay only with you, we do not store, parse, or use them for advertising

Maximal data protection

and confidentiality

Support of all legal provisions

for reliable bookkeeping

Adaptive protection

against unauthorized access

Strict confidentiality policy

your company data are stored in a tokenized

form and are accessible only to you

Full compliance with all

requirements

to VAT and other taxes in the UAE

The platform is always relevant

due to automatic updates when the laws change

Personal data are stored

in accordance with the UAE Federal Decree Law

No. 45/2021 on the Protection of Personal Data

The platform is always relevant

due to automatic updates when the laws change

Personal data are stored

in accordance with the UAE Federal Decree Law No. 45/2021 on the Protection of Personal Data

Strict confidentiality policy

your company data are stored in a tokenized form and are accessible only to you

The platform is always relevant

due to automatic updates when the laws change

Adaptive protection

against unauthorized access

Support of all legal provisions

for reliable bookkeeping

Full compliance with all requirements

to VAT and other taxes in the UAE

Why businesses choose Sahl.Tax

No More Manual Data Entry

AI automatically categorizes bank transactions and creates journal entries. Stop wasting hours on repetitive bookkeeping tasks.

Tax Forms in Minutes, Not Days

Generate EmaraTax-ready VAT and Corporate Tax forms instantly. No manual calculations, no formatting errors.

Save Over AED 33,000/Year

Replace traditional accounting agencies charging AED 3,000+/month with automated software starting from AED 0.

100% Accurate Bank Processing

AI-powered statement parsing with built-in validation eliminates the errors that come with manual reconciliation.

6 Languages Supported

Full interface in English, Arabic, Russian, French, German, and Hindi. Generate bilingual reports for any stakeholder.

Free PDF Tools Included

Sign PDFs, create, split, compress, convert from images or text, and OCR — all the document tools you need, built right in.

Built for UAE Free Zones

Specialized QFZP support with 0% corporate tax handling, qualifying income tracking, and Free Zone-specific compliance.

If you are an accounting company, transfer your work to Sahl.Tax and speed up the processing of statements and invoices. Favorable rates and integration with your accounting systems

Simple and Transparent Pricing

- Up to 120 invoices per year

- VAT calculation at 5% UAE standard rate

- Basic bank statement import (PDF)

- P&L and basic financial reports

- EmaraTax form generation

- Automated bank statement imports (daily, weekly, or monthly)

- VAT and corporate tax calculations (0% for QFZP, 9% for non-qualifying income > AED 375,000)

- Basic EmaarTax form preparation

- Automated reconciliation for transactions and invoices

- Invoice creation from photos, PDFs, Excel, WhatsApp, or existing systems

- Up to 3 companies per account

- All Start Plan features, plus:

- AI-support, including AI-powered invoice generation

- 24/7 support in English and Arabic in Accounting

- Automated integration with your CRM: Zoho, MS Dynamics, SalesForce.com, SAP

- Multi-currency support for international operations

- Unlimited companies per account

- All Business Plan features, plus:

- Priority 24/7 support

- Custom API integrations for complex workflows with your Software by request

- Advanced audit-ready reporting and analytics by request